IRPC '17: Refiners consider MARPOL impacts, electric vehicle trend

By Adrienne Blume, Executive Editor

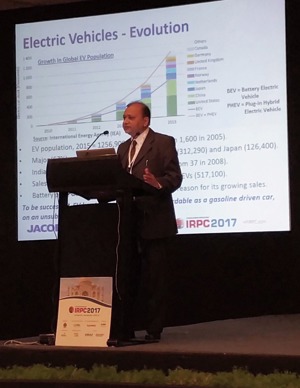

NEW DELHI, INDIA—Sanjay Shah, Group Manager for Jacobs Consultancy Ltd., presented a second keynote address on Day 2 of IRPC 2017. He spoke about evolving trends in the refining market with respect to shifts in fuel preferences, and the impacts of MARPOL legislation.

Mr. Shah outlined several key challenges for refiners, including increased competition and pressured margins due to the current down cycle in the market; significant reductions in CAPEX and worker layoffs; deceleration in Chinese energy demand; climate change mitigation actions that call for increased use of renewable fuels and alternative energies; and the need to improve energy efficiency and consumer access to low-cost energy.

The electric vehicle (EV) market has risen to more than 1 MM cars as a result of joint efforts by governments and industry, Mr. Shah said. EV use is anticipated to continue to grow, with faster expansions seen in OECD countries and China. However, the EV market will require significant policy support and infrastructure for expansion.

MARPOL Annex impacts. The MARPOL regulations affect approximately 3 MMbpd of high-sulfur marine fuel being used by more than 50,000 ships worldwide, representing 96% of worldwide tonnage, Mr. Shah said.

The regulations present a significant potential for disruption by 2020 in the form of diesel and fuel oil price increases, as well as hikes in the sweet-sour crude price differential. Compliance challenges for shippers and refiners are varied. Shipowners have several options:

- Switch from high-sulfur bunker fuel to marine gas oil/marine diesel oil

- Switch to LNG via fueling system retrofits, or build new ships and add bunkering facilities

- Use high-sulfur bunker fuel and seawater scrubbing

Refiners, on the other hand, are scrambling to produce the necessary fuels in light of uncertain demand. Collectively, they must produce either 3 MMbpd of less than 0.5 wt%-sulfur marine fuel, or eliminate 3 MMbpd of high-sulfur fuel oil.

"Reshuffling the marine fuel supply will not be easy," Mr. Shah said, and noted that marine fuel demand is approximately 4 MMbpd at present.

Refining industry response to MARPOL. Refiners' potential response will depend on refinery location and complexity. Coking refineries could increase their distillate output to meet the increased marine diesel/gas oil demand. Prices for distillates would increase as a result of the higher demand for marine fuel. Coking refineries would also benefit from low prices for high-sulfur heavy crude oils and residues.

Although fuel oil refineries would benefit from the increased distillate output to meet higher marine fuel demand, a number of downsides exist: demand for high-sulfur marine fuel will decrease; prices for light, low-sulfur crudes will increase; and high-sulfur residues would need to be upgraded to meet demand for low-sulfur fuels.

LNG as an alternative fueling option has an attractive payback for retrofits, but fueling infrastructure would be needed to support such operations, Mr. Shah said.

IRPC 2017 is taking place at the Taj Palace in New Delhi from April 18–20.

Comments