Ethylene downcycle puts nearly 25% of capacity at risk of closure

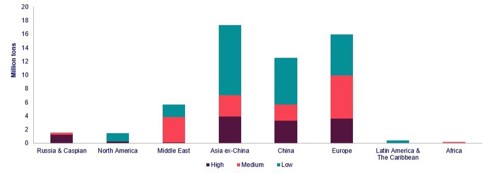

A series of unprecedented challenges to the global ethylene industry means that as much as 24% of global capacity is now under some threat of permanent closure according to new research by Wood Mackenzie. The report ‘Global Steam Cracker Closure Threat 2024’ states that 114 assets out of 330 screened are at some risk. This represents around 55 MMtpy of 2023’s total global ethylene capacity with more than half of that figure being at a medium or high risk of closure. “The global ethylene industry is currently navigating a downcycle,” says Alan Gelder, Vice President of Refining and Chemicals Research at Wood Mackenzie. “The industry has faced multiple headwinds and uncertainties, stemming from a global pandemic, the Russia-Ukraine and Israel-Hamas conflicts, an economic downturn and significant capacity overbuild.”

China’s growing self-sufficiency reshaping global supply dynamics. The report states that China’s strategy of phasing out small and aged facilities and replacing them with more cost-competitive and energy-efficient crackers will have an impact domestically and across Asia.

Wood Mackenzie has identified 3.3 MMt of Chinese ethylene capacity as being at high risk of closure and 2.4 MMt as being at medium risk. China’s increasing ethylene self-sufficiency will impact Northeast Asia producers the most with 9 MMt of capacity vulnerable to closure. The report adds that Southeast Asian crackers benefiting from advantaged feedstock will not be affected as negatively. “China’s substantial investments between 2020-2027 have reshaped global supply dynamics, leading to a structural surplus in Asia and persistent low or negative profit margins,” says Kelly Cui, Principal Petrochemicals Analyst at Wood Mackenzie.

European crackers facing headwinds. The report also states that Europe has 2.6 million tons of ethylene capacity which is at high risk of closure before the end of the decade, with 84% of European high risk rated units located within Western Europe. “Europe is experiencing unprecedented supply fragility amid rising energy prices caused by the Russia-Ukraine conflict and subdued demand,” says Mohamed Chilmeran, Research Analyst for Oils and Chemicals at Wood Mackenzie. “This has resulted in heightened rationalisation pressures and a stall in new investments.”

Steam cracker capacity at risk of closure, by region

* High risked assets include announced closures

Source: Wood Mackenzie Ethylene Aset Benchmarking Tool

Global operating rates and margins remain subdued. Wood Mackenzie data states that global operating rates for steam cracker hit a low of 82% in 2023, which is significantly below the pre-2019 levels of over 90%. Projections indicate continued suboptimal rates (remaining below 86%-89% in the next decade) unless further rationalisation occurs. Margins along the petrochemical value chain remain depressed, with ethylene return on investments (ROIs) plummeting to a new low of -1% in 2023 and is projected to stay in this negative territory until 2027.

The report concludes that as China continues to add world-scale cracker complexes through this period, the diminished ROI fails to stimulate further investments. However, overall operating rates are expected to recover after 2026, driven by capacity rationalisation and an uptick in demand growth.

Comments