EIA: Seasonality of US distillate consumption, stock levels declining

Changes in demand trends, trade patterns, and fuel specifications have significantly reduced the role of traditional seasonal factors in driving US distillate markets. Historically, distillate use in the United States was highly seasonal because of its use as a home heating fuel. In recent years, use of distillate as a heating fuel has decreased significantly, while its use as a transport fuel has remained relatively flat.

Distillate stocks, which were traditionally drawn down during winter in recent years, have shown little change or even have built over the October-March winter heating season. However exports of distillate fuels, a growing portion of the overall disposition of US distillate production, have actually become more seasonal in recent years, but because the net export peak occurs in the summer months, this change serves to offset the winter peak in domestic heating demand.

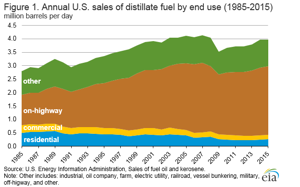

Distillate fuel has a variety of uses, primarily on-highway transportation for both light- and heavy-duty vehicles. Distillate fuel is also used as a heating fuel in homes and businesses; as a fuel for certain industrial processes, agriculture, and farming; and, to a lesser extent, as a fuel for electricity generation. While use of distillate for home heating has decreased, the share of distillate used for transportation has increased. US consumption of distillate went from 2.9 MMbbl per day (bpd) in 1985 to 4.0 MMbpd in 2015. In 1985, 504,000 bpd (18%) of US distillate sales/deliveries were to residential customers, presumably for home heating use, and 1.1 MMbpd (40%) of sales/deliveries were to on-highway transportation customers.

In 2015, the residential customer sales/deliveries were down to 260,000 bpd (7%), while on-highway transportation sales/deliveries increased to 2.5 MMbpd (64%). This trend is even more prominent on the East Coast, where residential sales went from 395,000 bpd (36%) of sales/deliveries in 1985 to 241,000 bpd (19%) of sales/deliveries in 2015, compared with on-highway transportation sales/deliveries increasing from 354,000 bpd (32%) to 717,000 bpd (58%) over the same time period. Distillate sales to the commercial sector followed a similar annual pattern of decline as the residential sector. The decreasing use of distillate for heating by residential and commercial customers and the increasing share of distillate used for on-highway transportation, which does not display significant seasonal variation, removes much of the traditional seasonality in overall domestic demand for distillate.

Over the same period that home heating use of distillate declined, once-disparate specifications for distillate converged to a common ultra-low-sulfur formulation, reducing the overall volumes and distinct kinds of distillate stocks held and making large swings in inventory levels less common. Historical seasonality in distillate markets is illustrated by the change in distillate inventories during the heating season. Until recently, inventories consistently started the heating season at a high level and were drawn down, with the lowest inventories of the year typically coming just at the end of the heating season. This seasonal pattern held true in EIA monthly US distillate inventories every year between 1945 and the 2007-08 winter season. The winter of 2008-09 marked the first time on record where distillate inventories increased over the October to March period. More recently, distillate inventories in March were higher than in October for three of the past five heating seasons.

The volume and seasonality of distillate exports, which are highest outside of the heating season, have grown in recent years. These changes have made exports a more important offset to the seasonality from heating oil demand that still peaks in the winter, albeit at much lower volumes compared with prior to the decline in the use of distillate as a residential heating fuel. US distillate exports have grown to 1.2 MMbpd in 2016 and set a new monthly record high of 1.5 MMbpd in May 2017. As export volumes have increased, so too has the size of the seasonal swings between winter and summer. Since 2013, distillate exports outside of the heating season were, on average, 161,000 bpd higher than during the heating season, compared with an average of 116,000 bpd higher from 2009 to 2012.

Comments