2020 AFPM Summit: Artificial intelligence in the downstream

Artificial intelligence in the downstream

STEVE ROBERTS and PATRICK LONG, Opportune LLP

Artificial intelligence (AI) is no longer simply an industry buzzword. Today, it is a prevalent technology that has made inroads in nearly every industry sector, from healthcare and retail to manufacturing and education. Within the energy industry, AI has been more widely seen in the upstream oil and gas sector, analyzing the many facets of reservoir data to find reserves, pick the right bits and determine how best to drill. Even with the myriad use cases in the upstream sector, AI has been slow to make its way into everyday use in the downstream sector.

Distrust and slow to change. The downstream energy sector is based on tradition and heavily rooted in processes. Habits and patterns are learned over time and, after a while, the industry has developed its own momentum for how molecules flow from the wellhead to a refinery and eventually to consumers as refined products. The downstream resistance is based on several factors.

AI remains a “black box.” While it guides us to work each morning with traffic apps or helps govern our purchases with sales platforms, it still is very much a mystery and not palpable to the average worker in downstream—we are more apt not to trust what we do not understand. Second, depth of industry knowledge and breadth of subject matter expertise within organizations prevent quick adoption of AI. Why should I implement a new technology when my organization has experts who are well-paid to take the vast amount of inputs and make decisions effectively?

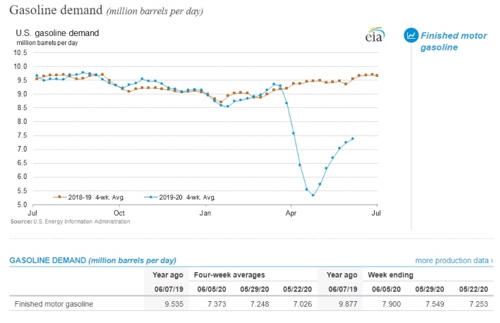

Breaking down barriers. How can these roadblocks be overcome? If only there was a “once-in-a-lifetime” event that wreaked havoc on the supply chain. Enter COVID-19 and the precipitous drop in refined products demand overnight—especially kero-jet fuel. However, as states reopen their economies and start the recovery process, gasoline demand has begun to rebound, as shown in FIG. 1.

FIG. 1. U.S. gasoline demand, MMbpd. Source: U.S. Energy Information Administration.

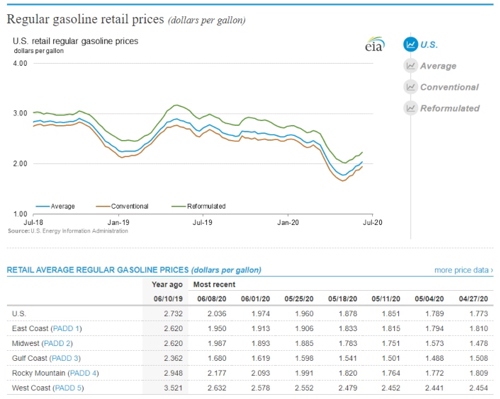

Likewise, as another indicator and signal for forecasting, gasoline prices are also rebounding (FIG. 2).

FIG. 2. U.S. regular gasoline retail prices, $/gal. Source: U.S. Energy Information Administration.

Still, blanket statements no longer apply for how the U.S. is slowly returning to a “new normal.” Regional differences, rural vs. urban, liberal vs. conservative, age demographics and weather patterns (to name a few) are creating an environment where forecasts are anything but normal. Conventional models look at a range of factors: historical demand, seasonal demand, overall market prices, new car sales, market activity and supply levels to determine forecasts. The forecast then, in turn, drives refinery production schedules and distribution plans.

The COVID-19 “wrench” in the plans. The COVID-19 situation and use case are primed for the effective use of AI tools. Gone are the base assumptions and reliance on wisdom from past experiences. We have never walked these paths before, so we need a tool that can ingest a myriad of factors that vary regionally. We need to train models and determine the strength of the various factors and which drive demand the most.

In some regions, price might be the determining factor that drives demand. In others, it might be new school schedules or vacation rental property occupancy levels that serve as a leading indicator for demand. There has never been a better time to embrace new technologies like AI that have been proven again and again in other industries.

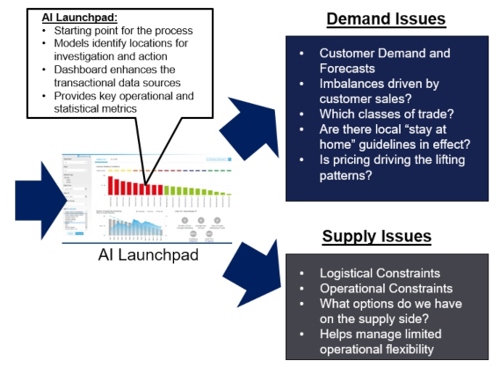

AI done right within the organization. Leveraging digital technologies like AI can serve as the foundation to enable greater margin enhancement opportunities and, ultimately, drive downstream value chain optimization efforts (FIG. 3).

FIG. 3. Digital technologies like AI can serve as the foundation to enable greater margin enhancement opportunities, driving downstream value chain optimization efforts. Source: Opportune.

Like any new change, you will need a champion that has the full support of management. Focus on an area to solve rather than “boiling the ocean.” Do you want to tackle avoidance of runouts? Is working capital is too high? Maybe the “hustle costs” of replenishing are excessive in an area? Perhaps supply is stranded in one part of the country when another region is seeing inventories fall?

Regardless of the problem, select an area and begin. Only then will you have a chance to make the most optimal production and distribution decisions in the face of unprecedented change and circumstance.

To learn more about Opportune LLP, visit https://opportune.com/

ABOUT THE AUTHORS

STEVE ROBERTS is a Director in Opportune LLP’s Process and Technology practice. He has more than 20 years of experience consulting in the energy industry, providing clients with trading and risk management for process and system implementation, supply chain optimization, asset acquisition integration and business analytics. Prior to joining Opportune, Mr. Roberts worked at Andersen Consulting and Accenture in the energy practice. Throughout his career, he has worked with integrated supermajor oil companies, midstream energy companies, merchant refiners and global banks. Mr. Roberts earned a BS degree in chemical engineering from Texas A&M University.

PATRICK LONG is a Director in Opportune LLP’s Process and Technology practice. He has more than 20 years of experience in providing clients with energy trading and risk management, packaged software implementation, trading and risk processes, and business process automation. He leads the BI initiative within the firm, and focuses on applying BI tools (e.g., Spotfire and Tableau) to client data to allow proper insight for management around both upstream and downstream business issues. Prior to joining Opportune, Mr. Long worked in the energy consulting trading and risk systems practice at Accenture, where he managed multiple project teams through the entire process of software selection to successful implementation of trading and risk management systems for energy trading entities.

Comments