EIA: Propane exports drove 2016 US petroleum product export growth

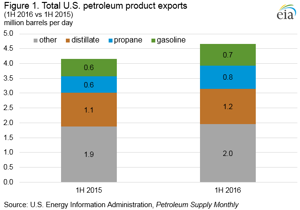

In the first half of 2016, the US exported 4.7 MMbpd of petroleum products, almost 10 times the crude oil export volume, an increase of 500 Mbpd over the first half of 2015. While US exports of distillate and gasoline increased by 50 Mpbd and nearly 140 Mbpd, respectively, propane exports increased by more than 230 Mbpd. Propane is now the second-largest US petroleum product export, surpassing motor gasoline. While total US petroleum product exports grew, export destinations remained largely unchanged.

Mexico, Canada, and the Netherlands received the greatest volumes of US petroleum products in the first half of 2016, importing 775 Mbpd, 579 Mbpd, and 271 Mbpd, respectively. Exports to these nations were, respectively, 129 Mbpd, 67 Mbpd, and 66 Mbpd above their level in first half of 2015.

Distillate exports, the largest component of US petroleum product exports for many years, averaged 1.2 MMbpd in the first half 2016, an increase of 50 Mbpd from the first half 2015. Central and South America accounted for the largest share of US distillate exports, averaging over 620 Mbpd in the first half of 2016, up more than 30 Mbpd from the first half of 2015. Chile remained the region's largest importer of US distillate in the first half 2016, averaging over 106 Mbpd. The largest single destination overall for US distillate exports was Mexico, which averaged 147 Mbpd in the first half of 2016, an increase of 3 Mbpd over the first half of 2015. Despite a well-supplied distillate market in Asia, US exports to Singapore increased to 15 Mbpd in the first half of 2016, up from 11 Mbpd in the first half of 2015.

US propane exports increased from 562 Mbpd in the first half of 2015 to 793 Mbpd in the first half 2016. Exports to Asia and Oceania accounted for 94% of this growth. Japan imported the most US propane at 159 Mbpd in the first half of 2016, an increase of 111 Mbpd from 48 Mbpd in the first half 2015. Exports to Panama, however, fell from 41 Mbpd in the first half 2015 to 7 Mbpd in the first half 2016.

The large increases in exports to Japan and decreases in exports to Panama could be a result of reduced ship-to-ship transfer activity, following narrower price differentials between the US and Asia. Some of the propane exports from the US that undergo ship-to-ship transfers will cite the location of the transfer and not the final destination of the propane. This often results in larger-than-actual export numbers for the countries where the ship-to-ship transfers take place and in less-than-actual numbers for some final destinations. For example, export data involving ship-to-ship transfers may show Panama as the destination of a propane export cargo eventually destined for Japan or other countries in Asia.

Gasoline exports increased 138,000 b/d in the first half of 2016 compared with the first half of 2015. North America (Canada and Mexico) accounts for the majority of the growth with an increase of 92 Mbpd. Mexico represents the largest single recipient of US gasoline exports at 363 Mbpd, up from 283 Mbpd in the first half of 2015. As part of its energy sector reforms passed in 2013, Mexico liberalized the country's energy sector, allowing market participants other than state company Petroleos Mexicanos (PEMEX). In January 2016, as part of the liberalization process, Mexico began to allow companies besides PEMEX to import fuels, resulting in increased exports from nearby refineries along the US Gulf Coast. Canada is the second-largest recipient of US gasoline at 66 Mbpd in the first half of 2016, up from 55 Mbpd in the first half of 2015.

Despite growth in the total volume of US petroleum product exports, their regional distribution has not changed significantly from 2005 to 2015. In 2015, over 60% of exports remained within the Western Hemisphere, down only modestly from approximately 65% in 2005. North America's share of total US exports is down nine percentage points, while Central and South America's share is up six percentage points. Exports to other global regions remained steady, with every region's share of US exports staying within two percentage points of their 2005 share.

Readers who follow EIA's export data will likely know that the agency recently made significant improvements in its estimates of weekly export data by using near-real-time export data obtained from US Customs and Border Protection. The recent changes in the weekly export data do not affect the monthly data cited in this article, which reflect official trade statistics published by the US Census Bureau.

US average regular gasoline retail and diesel fuel prices decrease. The US average regular gasoline retail price dropped slightly to $2.22/gal, down $0.10 from the same time last year. The Rocky Mountain price dropped two cents to $2.25/gal, the Midwest price dropped $0.01 to $2.14/gal, and the Gulf Coast price dropped less than a penny to $1.96/gal. The East Coast price rose $0.01 to $2.20/gal, while the West Coast price rose only modestly, remaining at $2.65/gal.

The US average diesel fuel price fell one cent from a week ago to $2.38/gal, down nine cents from the same time last year. The Rocky Mountain price fell $0.02 to $2.47/gal. The West Coast, Midwest, and Gulf Coast prices fell $0.01 each to $2.64/gal, $2.36/gal, and $2.23/gal, respectively. The East Coast price remained virtually unchanged at $2.39/gal.

Propane inventories gain. US propane stocks increased by 1.5 MMbbl last week to 103.3 MMbbl as of September 23, 2016, 4.5 MMbbl (4.6%) higher than a year ago. Gulf Coast and East Coast inventories increased by 1.7 MMbbl and 0.2 MMbbl, respectively, while Midwest and Rocky Mountain/West Coast inventories decreased by 0.3 and 0.1 MMbbl, respectively. Propylene non-fuel-use inventories represented 2.7% of total propane inventories.

Comments