Global diesel prices likely to weaken in 2014 with startup of Jubail refinery

4/23/2013 12:00:00 AM

In product markets, the new refinery will add to the supply of clean diesel in Saudi Arabia and Europe -- markets typically supplied by India. Since Indian refiners export diesel to so many markets, the appearance of this competing supply source will have bearish consequences for global diesel prices, the consultants predict.

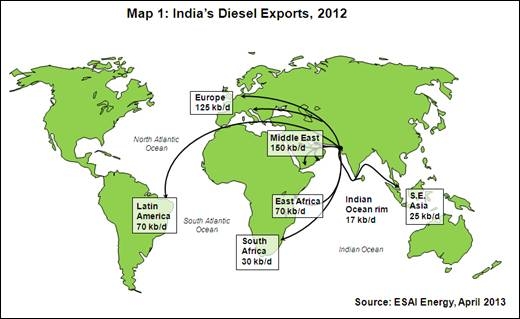

In product markets, the new refinery will add to the supply of clean diesel in Saudi Arabia and Europe -- markets typically supplied by India. Since Indian refiners export diesel to so many markets, the appearance of this competing supply source will have bearish consequences for global diesel prices, the consultants predict.India’s private refiners exported close to 1.2 million bpd of products in 2012, 485,000 bpd of which was diesel (see map below). Due to its geography, India’s refiners have access to markets from the Atlantic Basin to Asia.

The Jubail refinery, a joint venture of Saudi Arabia and Total, will have the capacity to produce 235,000 bpd of ultra-low-sulfur diesel (ULSD). This output will make Saudi Arabia, the destination of 85,000 bpd of Indian diesel exports last year, now a net exporter.

Additionally, Total is likely to export some of its share of diesel production, about 70,000 bpd, to Europe, potentially weakening Reliance’s position in that market, according to the consultants.

With India’s domestic market experiencing weak demand and new state-owned capacity, India’s private refiners must look to other export markets, such as South Africa, Latin America and Asia.

“There are direct consequences for all key diesel markets,” said Vivek Mathur at ESAI Energy. “Jubail will add to the availability of clean diesel to Europe, where demand continues to collapse. In 2014, the growing supply-demand mismatch will weaken the diesel spread to Brent.

"Unless India’s private refiners cut runs, they will have to target the Asian market," he added. "But with China’s emergence as a diesel exporter, competition among suppliers will likewise be bearish for Singapore gasoil spreads to Dubai.”

Comments