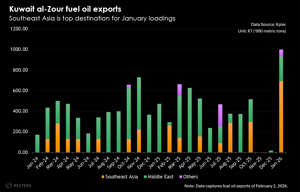

Record January fuel oil exports from Kuwait's al-Zour refinery weigh on Asian market

- About 70% of volumes bound for Southeast Asia

- Al-Zour refinery production recovers after Q4 shutdown

- Weaker fuel oil demand from Kuwait's power sector

Kuwait's al-Zour refinery ramped up fuel oil exports in January to all-time highs after recovering from an outage, with most of its cargoes bound for Southeast Asia, ship-tracking data showed on Monday.

The surge in supply from Kuwait, a major fuel oil exporter, will boost availability in bunkering hubs such as Singapore and weigh on prices in Asia, traders and analysts said.

Kuwait's exports of very low sulfur fuel oil (VLSFO) exceeded 1 MM tonnes (t) (205,000 bpd) in January, for the highest monthly volume on record, data from Kpler and LSEG showed.

(click image to enlarge)

The rebound followed two months of near-zero exports, when fourth quarter production dropped after an outage in some parts of the 615,000-bpd al-Zour refinery.

Higher output. The refinery, which resumed operations in the second half of December, is now running at nearly full capacity, a source familiar with the matter said on condition of anonymity.

Kuwait Petroleum Corp and its subsidiary KIPIC did not immediately respond to a request for comment.

"Weaker fuel oil demand from the power sector was a key contributor to this surge," said Palash Jain, Middle East oil market specialist at FGE NexantECA, in addition to higher refining output.

"Colder-than-normal winter conditions, along with higher electricity imports from Saudi Arabia, reduced Kuwait's power demand on a year-on-year basis," he added.

Exports mostly headed to Asia. Most of the VLSFO cargoes loaded in January were bound for Asia, with five cargoes set to arrive in Singapore, with others destined for Fujairah in the United Arab Emirates and Qatar.

"The VLSFO market is likely going to see pressure this quarter from the rise in Kuwait's exports," said Royston Huan, senior oil products analyst at Energy Aspects.

"This will exert further near-term pressure on hi-5 spreads, which are already at about $50 per ton levels, led by strength in the high-sulfur fuel oil (HSFO) complex," Huan added.

The hi-5 spread, or price difference between VLSFO and HSFO, has narrowed by more than 30% from the start to the end of January, LSEG data showed.

Asia's spot premiums for VLSFO have softened after a brief rebound in mid-January, while the prompt February-March spread flipped into contango at end-January.

The term describes a market in which prompt prices are weaker than those in future months.

Since al-Zour came online in late 2022, Kuwait has become a major exporter of refined products, particularly VLSFO, to Asia and other shipping hubs in the Middle East.

Comments