Sinopec: China's oil consumption to peak by 2027

- Trump adds uncertainty to China's energy industry

- Diesel and gasoline demand to weaken

China's oil consumption is set to peak by 2027, state refining giant Sinopec said on Thursday, as diesel and gasoline demand weaken in the world's biggest oil importer, a slowdown that has rattled global oil markets this year.

The 2027 peak will top out at no more than 800 MM tonnes (16 MMbpd) of crude oil, Sinopec said. Last year, Sinopec forecast peak China oil demand, also at 800 MMt, around the middle of 2026–2030.

China's energy sector faces fresh uncertainty in 2025 with President-elect Donald Trump's return to the White House raising the prospect of heightened trade tensions and potential disruption to Iranian oil exports, said Wang Pei, deputy general manager of the Sinopec Economics and Development Research Institute.

Trump is expected to tighten sanctions enforcement on Iran, which exports roughly 1.5 MMbpd of oil, mostly to China and its independent refiners.

"We want to remind everyone to pay attention to the uncertainty of Trump's Iran policy," Wang said during Sinopec's annual outlook event in Beijing. Trump, however, could also reduce tensions in Ukraine and the Middle East, removing some risk premium, she added.

Driven by the shift towards electric vehicles and the rise of trucks fueled by liquefied natural gas (LNG), the speed of China's move toward peak oil has taken the industry by surprise, with crude imports on track to peak as soon as 2025, analysts have said.

The 800-MMt peak compares with the 750 MMt to be consumed in 2024, when demand is on track to drop about 10 MMt from last year for just the second decline in two decades, Sinopec said.

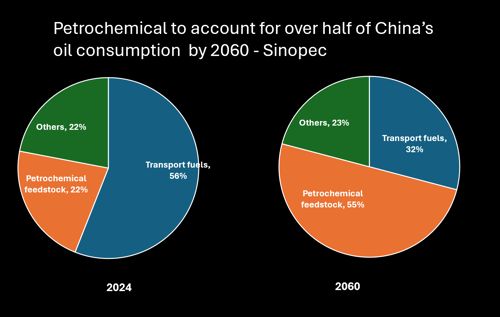

With broader use of LNG and electric vehicles reducing demand for gasoline and diesel, the petrochemicals sector will ultimately consume more oil than the transport sector, accounting for 55% of oil consumption in 2060, up from 22% in 2024, Sinopec said.

Diesel demand is expected to fall 5.5% to 174 MMt in 2025, as LNG-fueled trucks accounted for 22% of truck sales in the first three quarters of 2024.

Gasoline demand is set to decline 2.4% to 173 MMt in 2025, with electric vehicles displacing about 26 MMt or 15% of gasoline consumption.

Of the three key refined products, only aviation fuel use is expected to grow next year, by 7% to 45.5 MMt.

Sinopec, Asia's biggest refiner, also said China's natural gas consumption may peak earlier but at a higher level than it forecast last year.

By 2030, China's natural gas consumption is expected to reach 570 Bm3 and plateau at around 620 Bm3 between 2035 and 2040. In last year's forecast, Sinopec put the plateau at 610 Bm3 by around 2040.

Natural gas consumption is forecast at 458 Bm3 in 2025, up 6.6%, Sinopec added, attributing the growth to increased LNG use in the trucking sector, the addition of new gas power generating capacity, and stronger demand from the industrial and residential sectors.

It also increased its forecast for China's carbon emissions from energy-related activities to peak at between 10.8 Bt and 11.12 Bt before 2030. Last year, it forecast a peak at around 10.1 Bt between 2026 and 2030.

(1 tonne = 7.3 barrels)

Comments