California law and refinery closure reflect ongoing challenges for state’s fuel market

On October 14, California (U.S.) Governor Gavin Newsom signed bill Abx2-1 into law, empowering California regulators to set and adjust minimum petroleum product inventory levels for refiners in the state, in part to address the state’s fuel price volatility. Shortly after, refiner Phillips 66 announced plans to close its Wilmington refinery in Los Angeles by the end of 2025, citing uncertainty surrounding the long-term sustainability of the refinery.

What will the new legislation do? The new law empowers the California Energy Commission (CEC) to develop and impose minimum storage level requirements for refined transportation fuels for each refiner in the state. The law allows regulators to adjust minimum storage volumes based on regional and seasonal market conditions, refinery size and storage capacity. It also empowers the CEC to consider the use of a tradable mechanism for compliance with the minimum inventory law, which the state has used in the past for programs such as its Low Carbon Fuel Standard (LCFS).

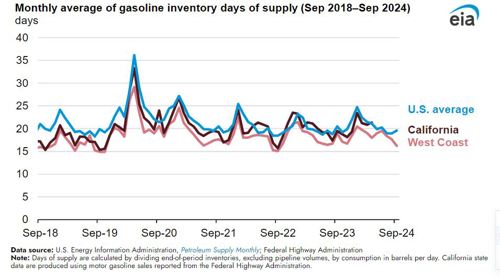

What is different about the California gasoline market? The bill is intended to prevent wide swings in the gasoline price. California retail gasoline prices are consistently among the highest in the country and regularly exceed the U.S. average price by more than $1 per gallon. While multiple factors contribute to higher retail gasoline prices in California, including higher crude oil costs and higher refining costs on the West Coast, the region has also historically maintained lower inventory levels relative to the rest of the country.

Market participants often use inventories to assess the availability of petroleum products. If inventories drop too low, retailers can struggle to secure the product they need, which increases prices as product becomes scarce. After removing pipeline volumes from total inventories, gasoline inventories in California have been consistently lower than the U.S. average on a days-of-supply basis. Days of supply is a measure of inventory relative to demand and is taken by dividing stock levels (in barrels) by consumption (in barrels per day). California’s inventory has averaged just over 20 days of supply over the last five years (2019–23), compared with the U.S. average of 21.6 days.

What will the refinery closure mean for California gasoline markets? Shortly after the new California legislation was signed into law, refiner Phillips 66 announced on October 16 that it plans to stop refining operations at its 139,000-bpd Wilmington refinery in Los Angeles during the fourth quarter of 2025. In the announcement, Phillips 66 indicated it will continue to pursue other uses for the facility, which may include continuing to import fuels through its existing petroleum infrastructure.

On October 29, Phillips 66’s Chief Executive Officer said the company's decision to shut down its Los Angeles refinery in 2025 was not an immediate response to any policy changes in California but rather due to its expectation that refining business in the state would become increasingly challenging.

Earlier this year, Phillips 66 completed the transition of its Rodeo refinery near San Francisco into a renewable diesel production facility that no longer processes crude oil. With the end of operations at its Wilmington plant, the company will officially stop all crude oil refining operations in the state.

The Wilmington refinery accounts for less than 1% of U.S. refining capacity, about 5% of West Coast refining capacity, and about 8% of the refining capacity in the state of California, according to EIA’s Refinery Capacity Report. The West Coast possesses relatively less pipeline capacity and other infrastructure to transfer petroleum products between refining centers from elsewhere in the United States, such as the U.S. Gulf Coast. As a result, the lost petroleum product supply from the Wilmington refinery will likely need to be met through higher utilization of other California refineries and increased imports of products such as gasoline.

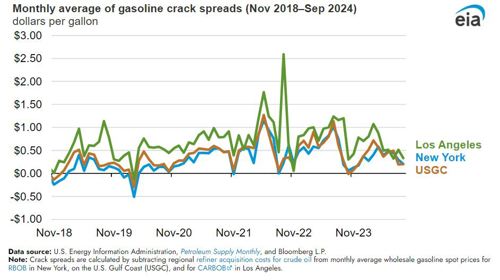

What is contributing to the refinery’s closure? Weak refinery margins have persisted on the West Coast and in the United States overall since the middle of this year. In May 2024, the crack spread for Los Angeles CARBOB (California Reformulated Blendstock for Oxygenate Blending)—an indicator of the profitability of refining gasoline from crude oil—dropped to 50 cents per gallon, about half of what it was the previous May. The Los Angeles spread hasn’t been below 50 cents per gallon on average in the month of May since 2019. Lower crack spreads in the second half of 2024 have been an issue for all U.S. refiners, not only those on the West Coast. The narrower spreads partly reflect global market conditions including more international refining capacity and weaker demand compared with the higher margin environment in 2022 and 2023.

Refinery crack spreads on the West Coast are typically higher than they are in other parts of the country, in part because of tighter supply-demand balances in the region, reflected by the lower average days of supply. Refiners in California must comply with the state’s Cap-and-Trade program, which requires them to bid for emissions allowances, as well as the state’s LCFS, which requires refiners (and importers or wholesalers) to buy carbon credits according to the volume of carbon-emitting fuels (such as gasoline and petroleum diesel) that they supply to the market.

The costs of compliance with these measures are partly reflected in the wider wholesale crack spreads. As a result, higher crack spreads alone may not necessarily indicate higher net profits for refiners in the state, although they do indicate relatively higher prices for gasoline overall. The West Coast also tends to have higher refiner acquisition costs for crude oil because crude oil production is limited in the region and routes to import crude oil are often longer. The higher acquisition costs do not directly affect the crack spread for gasoline, but they do contribute to higher overall fuel prices.

Despite the growing share of electric vehicles in California, the state remains a major destination for consumption of gasoline, ranking as the second-largest source of consumption of the fuel among the 50 states. However, regional refiners have struggled with the relative profitability of producing distillate fuel oil and jet fuel, some volume of which must also be produced with each barrel of crude oil refined to make gasoline. The increased penetration of renewable diesel into California’s diesel market reduces demand for petroleum diesel in the region, presenting additional headwinds to overall profitability for refiners in the state.

The disconnect in gasoline and diesel prices suggests that gasoline imports are likely to grow in importance as a source of future supply for the state. Unlike increasing in-state refinery production, importers can import gasoline when they expect it will be in demand without producing surplus volumes of other fuels with lower margins. However, importers face longer shipping times between when an order is placed from abroad and when a cargo of gasoline or another fuel ultimately arrives in the state. Importers must also locate foreign refiners capable of meeting the specifications on California’s unique gasoline formulation, CARBOB.

Comments