U.S. October gasoline imports hit post-pandemic low on slump in European shipments

- S. gasoline imports hit lowest since April 2020

- Sharpest declines in imports from Europe and Asia

- Low imports a symptom of global demand weakness

- S. Northeast imports from Europe at all-time lows

- End of European refinery maintenance, low U.S. stocks may boost imports

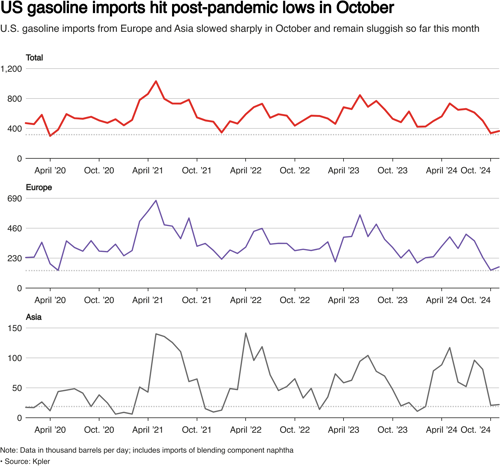

U.S. waterborne gasoline imports fell in October to their lowest since the COVID-19 pandemic, with European shipments to the U.S. Northeast hitting a record low and Asian cargoes more than halved from a year ago, according to traders and ship-tracking data.

The anemic flow to the top gasoline-consuming nation is showing signs of continuing this month amid weak demand and high production domestically, which could spell more trouble for global oil prices and refiners' profits.

Crude prices are not far off three-year lows hit in September due to weak demand from China, the world's second-biggest gasoline consumer, and refiners around the globe face a slump in profits to multi-year lows because of slowing economic growth and the rise in electric vehicles.

The U.S. imported 335,000 bpd of gasoline in October, down 37% year-on-year and the lowest since April 2020, according to data from trade analysts Kpler. So far this month, Kpler pegs imports at 365,000 bpd.

The sharpest drops in October waterborne deliveries were from Europe, the top gasoline shipper to the U.S., which fell to its lowest since the pandemic in May 2020 to 137,000 bpd, and from Asia, which slumped 74% from September to 21,000 bpd, less than half of last year's average, according to Kpler.

The bulk of imports from European refiners flow into the U.S. Northeast, which fell below 100,000 bpd last month, the lowest on record going back to 2016, according to vessel tracking data from Vortexa.

"November could be even lower," Vortexa analyst Rohit Rathod said. "No indication of recovery so far, with Europe losing out."

Weak European margins, strong Asian demand. European refiners are producing less gasoline because of weak profit margins and annual maintenance, FGE analyst Benedict Mangeolles said.

Benchmark Northwest European gasoline profit margins fell to below $6 a barrel on Nov. 18, a seven-week low, according to Reuters calculations.

The end of seasonal maintenance will increase European supply and, if prices fall, it may again become profitable to ship gasoline to the U.S., Mangeolles said.

"The arbitrage was largely closed until early November on the back of very bad economics from the EU," Sparta Commodities analyst Jorge Molinero said. Low gasoline stocks on the U.S. East Coast may also encourage higher imports, Molinero said.

Stocks in the region stood at 51.8 MMbbl as of Nov. 15, 6% below the five-year average for this time of year, data from the U.S. Energy Information Administration showed.

Total U.S. gasoline stocks were at 208.9 MMbbl by Nov. 15, 4% below the five-year average for this time of year, the data showed.

In Asia, refiners sold gasoline within the region as a string of refinery snags in the Middle East and Southeast Asia since mid-October boosted profits, two Singapore-based traders said.

Demand from key importers Vietnam, Malaysia and Indonesia has been strong over the past month, one of the traders said.

Asian gasoline refining margins have gained around 40 cents per barrel month-over-month in November, according to LSEG data. Asian demand in December will hinge on the duration of refinery outages and China's export program, though Lunar New Year and Ramadan festivities should be supportive in the first quarter of 2025, another Singapore-based trader said.

Domestic flows. An increase in waterborne and pipeline gasoline shipments within the U.S. also cut demand for international cargoes.

Gulf Coast refiners have operated at higher-than-normal rates for this time of year, when U.S. gasoline demand is weak historically. As a result, these refiners have had excess gasoline to sell, U.S. fuel traders said.

Waterborne gasoline shipments from the U.S. Gulf Coast to East Coast markets hit the highest since 2019, Kpler and Vortexa data showed. Total U.S. petroleum exports hit a record high earlier this month.

Gasoline and jet fuel shipments on the Colonial pipeline, which pumps fuel from Gulf Coast to East Coast, have risen steadily over the past two quarters, data from midstream analytics firm East Daley showed.

Comments