Zero-carbon ammonia for shipping faces cost, safety challenges

- Ammonia bunkering study finds 400 safety risks

- Shippers reluctant to order ammonia-fueled vessels

- Costs are 2–4 times more than traditional marine fuels

At one of the world's biggest bulk export ports in Western Australia, shippers safely completed the first transfer of ammonia from one vessel to another last month, a key test for its adoption as a marine fuel in the push for cleaner energy.

The first cargo ships that would be powered by ammonia are set to enter service in 2026, one of several alternatives the industry is tapping to shrink a carbon footprint accounting for nearly 3% of global emissions.

But ammonia faces major cost and safety hurdles as a shipping fuel compared to others, such as liquefied natural gas (LNG), methanol and biofuels.

Ammonia's appeal is that it is carbon free, and would be a zero-emissions fuel if made from hydrogen produced with renewable electricity.

But safety is a big challenge for the product typically used for fertilizers and explosives.

"Currently the lack of regulation, experience in use and toxicity of ammonia on board ships constitute major safety deterrents," said Laure Baratgin, head of commercial operations at mining giant Rio Tinto.

Top global iron ore producer Rio is the biggest exporter at Dampier, where the ammonia transfer trial was run. It operates dual-fueled bulk ships that run on traditional marine fuel or LNG, but has yet to charter or order ammonia-fueled vessels.

"Pending our confidence and that of our partners, industry, and communities, that the risks are sufficiently controlled, we will look to charter ammonia dual-fuel vessels, the specific timing of which remains uncertain," she told Reuters.

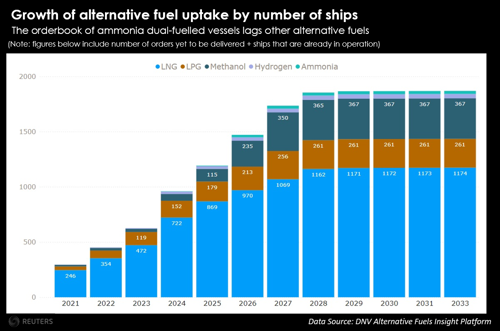

Other shippers are also hesitant. Globally, only 25 ammonia dual-fuel ships have been ordered as of 2024, trailing a fleet of at least 722 LNG-fueled ships and 62 methanol-fueled ships as of the same year which includes orders and ships that are already in operation.

Only two smaller ammonia-fueled vessels are in service now, including a tugboat in Japan.

Dangerous properties. Refueling ships, or bunkering, poses particular challenges with ammonia, which can cause acute poisoning and damage to the skin, eyes and respiratory tract.

"The greatest risk is leakage during bunkering operations," in addition to leakage from fuel tanks, said Yoshikazu Urushitani, general manager in the marine fuel division at Mitsui OSK Lines, which is designing an ammonia-powered bulk carrier.

A study by the Global Centre for Maritime Decarbonisation (GCMD) identified 400 risks associated with ammonia bunkering, which it says can be mitigated with measures such as emergency-release couplings to shut systems when a leak is detected.

The organization is developing a detailed emergency response plan for ammonia spills, which are harder to contain than oil spills.

"For oil, you see it - it stays there and it spreads out in water. But ammonia dissipates in air," said Lynn Loo, chief executive officer of GCMD.

Japan's Nippon Yusen Kaisha (NYK), which has agreed to build the world's first ammonia-fueled, medium-sized gas carrier, has developed equipment specifically for ammonia bunkering.

The industry will need to set guidelines for seafarers to safely manage the fuel, said Takahiro Rokuroda, general manager at NYK's Next Generation Fuel Business Group.

Singapore, the world's largest ship refueling hub, has shortlisted companies to study the viability of ammonia for power generation and bunkering and is developing ammonia bunkering standards.

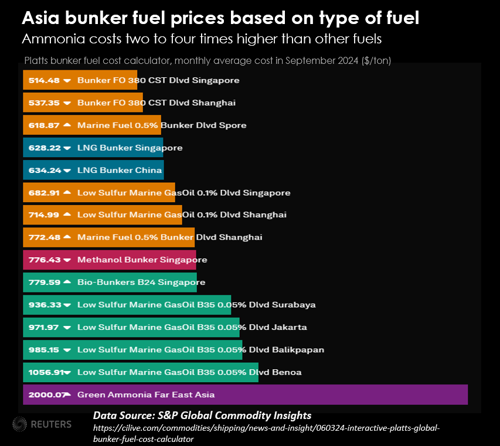

Prohibitive costs. Costs will have to drop sharply to make ammonia competitive in bunkering.

Powering ships with ammonia can cost two to four times more than with conventional fuels, industry figures show, due to limited supply for the marine sector and an energy density about two-and-a-half times lower than traditional fuel.

"If you want to travel the same distance, you either have to carry about two and a half times that amount of fuel, or you have to bunker more frequently so that you have enough fuel to be able to make that trip," said Loo.

Ammonia engines also need extra maintenance as the fuel is corrosive, engine manufacturer Wartsila says.

Still, the American Bureau of Shipping forecasts ammonia will account for about one-third of bunker fueling by 2050.

"We certainly won't bring any product to market until we are 100% certain that all risks have been duly managed," said Kenny MacLean, COO at bunker fuel supplier Peninsula.

Comments