Surge in U.S. ethanol exports offsets thriving production

Despite a jump in production, U.S. ethanol stocks dropped significantly last week, partly owing to a sharp rebound in gasoline demand, which neared three-year highs.

But record exports have been the factor keeping U.S. ethanol supplies in check over the last several months, even as output of the corn-based fuel additive set records of its own.

Plentiful, cheap corn and relatively low natural gas prices have supported profit margins for U.S. ethanol producers, which account for nearly 40% of annual U.S. corn use.

Ethanol output over the last three months was record-high for the period, coinciding with a 20% slide in U.S. ethanol prices CUUc1.

It was not clear if and when new ethanol production records could be set following the 2020 COVID-19 pandemic that choked off fuel demand, placing stress on the U.S. corn industry.

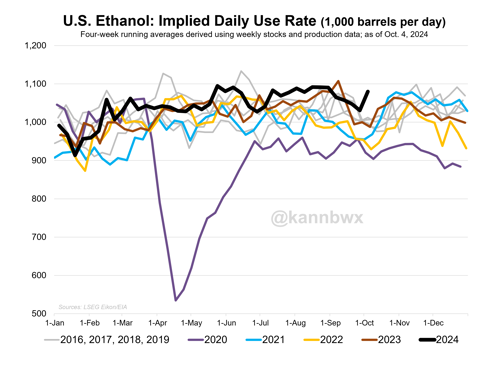

Demand for U.S. motor gasoline has not yet returned to pre-pandemic levels, which is a negative force for ethanol use. However, implied U.S. ethanol use has been strong in recent months, even setting some weekly records.

This comes as many countries are stepping up plans to reduce carbon emissions using biofuels and other sustainable fuels, offering the perfect opportunity for U.S. ethanol exporters.

The U.S. produces just over half of the world’s ethanol annually and is the leading supplier.

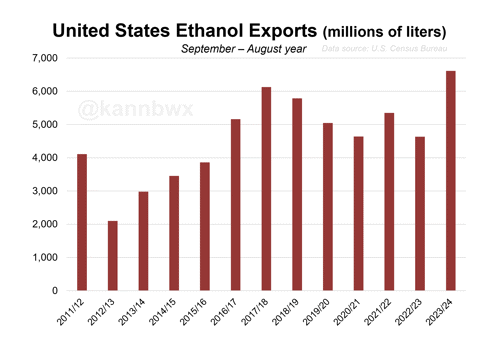

Meaty exports. Census Bureau data published shows U.S. ethanol exports at a record 6.6 B liters (1.75 B gallons) between September 2023 and August 2024, which spans the 2023–2024 U.S. corn marketing year.

August marked the fifth consecutive month in which a new monthly export record was set, and total ethanol shipments over that five-month period were 30% greater than 2018’s previous record for that stretch.

Canada accounted for 37% of the 2023–2024 U.S. ethanol shipments, and relatively new customer the UK came in second at 13%. Both trade relationships have been driven by the recent push for cleaner fuels.

The demand for corn-based ethanol in India, the No. 3 destination for U.S. ethanol, has become so strong that it has pushed domestic corn prices to record levels, turning the country into a net corn importer.

To ensure ample sugar supplies, India is trying to shift away from sugar-based ethanol, the primary offering from Brazil, a former U.S. ethanol customer. Brazil’s steep import tariffs on the U.S. fuel have been prohibitive to that trade over the past couple of years.

Brazil is the world’s No. 2 ethanol exporter, well behind the U.S., though its corn-based ethanol output has exploded over the past few years, now accounting for more than 20% of Brazil’s total ethanol production.

Corn balance sheet. Data from the U.S. Energy Information Administration (EIA) showed U.S. ethanol stocks plunged more than 5% last week to the lowest levels since December, though supplies are above average for the time of year.

However, the stock situation could have been much more cumbersome if not for the exports, especially given the strong production levels. Ethanol output and thus exports could remain robust in the coming months, a key time for U.S. corn processing, especially if the bumper corn harvest is realized.

Analysts expect the U.S. Department of Agriculture (USDA) on Friday to reconfirm its view that the in-progress 2024 corn harvest will be the second-largest on record behind 2023.

USDA’s September estimates pegged U.S. corn used for ethanol in 2024–2025 to fall slightly from 2023–2024, though this order may need to be flipped if ethanol production rates continue to shine through early next year.

Comments