Fewer tankers transit the Red Sea in 2024

The amount of crude oil and oil products flowing through the Bab el-Mandeb, the southern chokepoint at the mouth of the Red Sea, decreased by more than 50% in the first eight months of 2024.

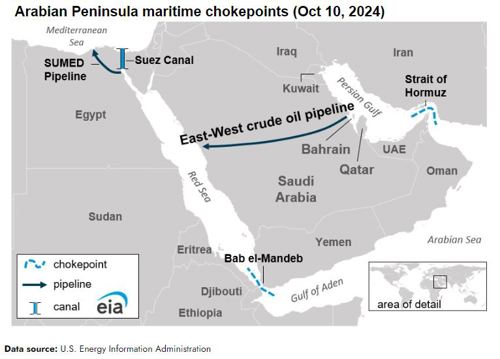

Chokepoints are narrow channels along widely used global sea routes, and they are critical to global energy security. The inability of oil to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices.

After Yemen-based Houthi militia attacks on commercial ships transiting the Red Sea started in November 2023, some vessels began opting to avoid the Bab el-Mandeb chokepoint—a narrow strait that borders the Yemeni coast and is the southern entrance to the Red Sea. Instead, they’re choosing to take longer, more costly routes around the Cape of Good Hope at the southern tip of Africa.

Oil trade flows in the Red Sea have decreased significantly over the past year. Oil trade flows through the Bab el-Mandeb Strait averaged 4 MMbpd in 2024 through August compared with 8.7 MMbpd in full-year 2023, according to Vortexa data.

The Suez Canal, the SUMED pipeline and the Bab el-Mandeb Strait are strategic routes for Persian Gulf oil and natural gas shipments to Europe and North America. The Suez Canal and SUMED pipeline are located in Egypt and connect the Red Sea with the Mediterranean Sea. The volume of crude oil and oil products flowing around the Cape of Good Hope increased to 9.2 MMbpd in the first eight months of 2024 from an average of 6 MMbpd in 2023, according to Vortexa data.

The Strait of Hormuz, located between Oman and Iran, connects the Persian Gulf with the Gulf of Oman and the Arabian Sea. The Strait of Hormuz is the world's most important oil chokepoint because large volumes of oil flow through the strait. In 2023, oil flows through Hormuz averaged 20.9 MMbpd or the equivalent of about 20% of global petroleum liquids consumption. In addition, around one-fifth of global liquefied natural gas (LNG) trade also transited the Strait of Hormuz in 2023.

Iran ranked as the world's third-largest oil and second-largest natural gas reserve holder in 2023, although international sanctions have constrained its production. Total petroleum and other liquids production in Iran rose from a recent annual low of less than 3 MMbpd in 2020 to an average of 4 MMbpd in 2023. Of this 4 MMbpd, almost 2.9 MMbpd was crude oil, and the remainder was condensate and hydrocarbon gas liquids.

Saudi Arabia was the world’s third-largest crude oil and condensate producer, the world’s top crude oil exporter, and OPEC’s top crude oil producer in 2023, when its output averaged 9.5 MMbpd.

Israel is the second-largest natural gas producer in the Eastern Mediterranean region, after Egypt. Natural gas production in Israel began growing in 2013 when the Tamar field began production. Since then, several more offshore natural gas fields have begun production and provided enough fuel to meet Israel's rising domestic natural gas needs as well as exports to Egypt and Jordan. In 2022, natural gas production in Israel totaled 808 Bft3.

Global oil prices and the U.S. market. Imports of crude oil from Persian Gulf countries to the U.S. have decreased over the past decade due to rising domestic production. In 2023, imports of crude oil from Persian Gulf countries to the United States averaged 609,000 bpd, down from 2 MMbpd in 2013. Imports from the region accounted for 9.3% of total U.S. crude oil imports in 2023.

Crude oil is traded globally, and regional impacts to international energy trade can have global price implications. Escalated tensions in the Middle East have increased the geopolitical risk for global oil price benchmarks in recent weeks. Following Iran’s attacks on Israel on October 1, 2024, the price of Brent crude oil—the international benchmark—increased, reaching $81/bbl on October 7. As of October 10, the Brent crude oil price was $79/bbl.

Comments