Singapore's middle distillates stocks edge up for third week to > 12 MMbbl

Singapore's middle distillates stock levels edged up for a third straight week, hitting above the 12-MMbbl mark, as the decline in jet fuel/kerosene net exports offset gains in diesel/gasoil net exports, official data showed on Thursday.

Inventories of diesel/gasoil and jet fuel/kerosene at key oil storage hub Singapore were at 12.016 MMbbl for the week ended August 14, up from 11.993 MMbbl in the previous week.

Net exports of jet fuel/kerosene fell by around 76% week on week, while net exports of diesel/gasoil dipped by the same percentage as well.

Total exports of the aviation and heating fuel declined by 76%, being the key contributor for this drop, though total imports also fell, offsetting a portion of this fall.

For diesel/gasoil, total exports rose by nearly 38% and total imports dipped by 34%.

Imports from India continued, while volumes from South Korea resurfaced after a week-long hiatus.

Analysts were still mixed on whether India-origin volumes will continue flowing to east of Suez markets, given the wider east-west arbitrage price spread since the start of this week.

So far, August arrivals from India should only be up to 67,000 tons, Kpler and LSEG shiptracking data showed.

For Middle East-origin barrels, the freight cost decline "has been more pronounced westward than eastward, encouraging diesel cargoes to continue to head west rather than east," said Sparta Commodities' James Noel-Beswick.

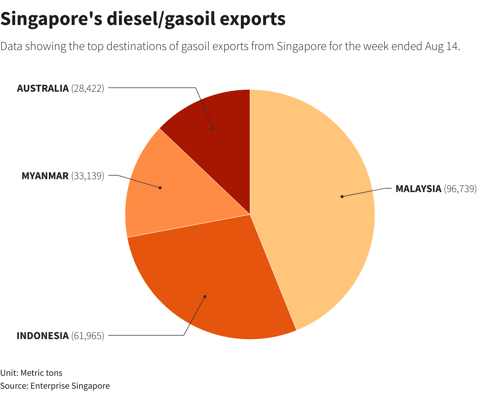

Key contributors for the exports of diesel/gasoil this week were mostly Australia, Malaysia, Indonesia and Myanmar, the usual regional suspects.

(1 ton = around 7.45 barrels for gasoil)

(1 ton = around 7.88 barrels for jet fuel/kerosene)

Comments