Mexico–U.S. energy trade value fell in 2023 on lower fuel prices

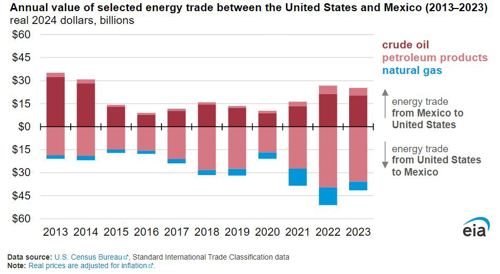

The value of all energy trade between the U.S. and Mexico decreased almost 15% from $77.8 B in 2022 to $66.5 B in 2023, adjusted for inflation. Lower fuel prices more than offset the increase in the volume of energy trade between the two countries. Energy trade value represents the total value of energy imports and exports between the two countries. It is influenced by both commodity prices and the volume of commodities imported and exported.

The value of inflation-adjusted U.S. energy exports to Mexico declined by 19% in 2023. The value of inflation-adjusted energy imports from Mexico decreased by 6% in 2023, according to data from the U.S. Census Bureau, which has been collecting this type of data since 1996.

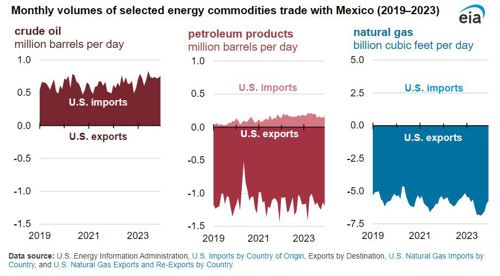

Crude oil. In 2023, the U.S. imported more crude oil from Mexico and paid less per barrel than in 2022. U.S. crude oil imports from Mexico averaged 733,000 bpd, 15% more than in 2022. Global crude oil prices declined in 2023, with the Brent crude oil spot price averaging $82.41/bbl compared with $100.94/bbl in 2022. Despite the increased import volumes, the lower crude oil prices reduced the value of U.S. crude oil imports from Mexico by 4% in 2023 compared with 2022. U.S. crude oil imports made up 81% of all energy imports from Mexico in 2023. The U.S. did not export any crude oil to Mexico in 2023.

Petroleum products. In 2023, Mexico was the largest export market for U.S. petroleum products. Mexico has an aging refinery system and struggles to maintain the output needed to satisfy its domestic petroleum product demand. As a result, Mexico imports U.S. petroleum products such as gasoline, diesel fuel and propane. Petroleum products accounted for 87% of the total energy exports from the U.S. to Mexico in 2023. U.S. petroleum product exports to Mexico averaged 1.2 MMbpd in 2023, up 1% from 2022. Although the volume of exports increased, the value of U.S. petroleum product exports decreased by 9% when adjusted for inflation, dropping to $36 B in 2023 from $40 B in 2022.

Natural gas. Natural gas trade mostly consists of pipeline shipments from the U.S. to Mexico. The U.S. exported a record amount of natural gas in 2023: 6.2 Bft3d, or 8% more than in 2022. U.S. natural gas exports to Mexico represented 13% of all U.S. energy exports to Mexico for the year. Due to lower prices, the trade value of natural gas in 2023 decreased by 52% from 2022.

Electricity. The U.S. and Mexico trade a small amount of electricity, primarily into California, New Mexico and Texas where transmission lines cross the U.S.–Mexico border. In 2023, only 0.14% of U.S. electricity consumption came from Mexico. During that year, U.S. electricity imports from Mexico increased by 20% from 2022 to 5.7 terawatthours (TWh), while U.S. electricity exports to Mexico decreased by 65% to 1.8 TWh, resulting in a net trade deficit of 3.9 TWh.

Comments