Weak Asia refining margins see swing to crude from the Americas

Australia (Reuters)—The profit from turning a barrel of crude oil into fuels in Asia is at the lowest in seven months, which is leading refiners to turn away from expensive Middle East grades and seek cheaper alternatives from the Americas.

Refiners are being hit by the double whammy of higher prices from Saudi Arabia, the top exporter and price-setter for much of the crude exported from Middle East, as well as soft demand for some refined products, including industrial and transport mainstay diesel.

The crack spread, or profit margin, from making fuels from a barrel of Middle East benchmark Dubai crude at a typical Singapore refinery ended at $2.27/bbl on Monday, down from $2.69 on May 10 and the lowest since Oct. 20. The margin is down 77% from its peak so far in 2024 of $9.91/bbl, reached on Feb. 13.

Refining margins have been squeezed in Asia as crude prices have risen faster than those for refined fuels, with global benchmark Brent crude futures rising from a six-month low of $72.29/bbl on Dec. 13 to a recent high of $92.18 on April 12, before moderating to end at $83.45 on Monday.

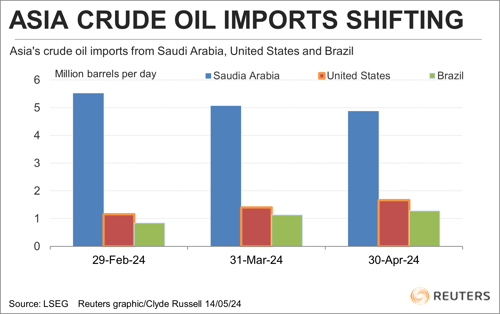

Asia's crude oil imports from Saudi Arabia, the U.S. and Brazil.

Making it tougher for refiners in Asia are the increases in official selling prices (OSPs) for crude from Saudi Arabia, which remains the top supplier to the world's biggest importing region.

Saudi Aramco, the state-controlled oil major, lifted its OSP for its benchmark Arab Light grade to a premium of $2.90/bbl over the Oman/Dubai average for Asian customers for June-loading cargoes. This was up from a premium of $2/bbl for May and took the premium to the highest since January.

There are signs that Asian refiners are trying to limit the volume of Saudi crude they purchase. Asia's imports from Saudi Arabia dropped to 4.88 MMbpd in April, down from 5.07 MMbpd in March and 5.52 MMbpd in February, according to data compiled by LSEG Oil Research.

Volumes from Saudi Arabia may remain constrained in coming months, with Chinese refiners expected to lower their imports from there by 5.8 MMbbl in June from May's imports of 45 MMbbl, according to sources with knowledge of the matter.

China is Saudi Arabia's largest customer in Asia, but has been overtaken by Russia as the top supplier to China, as refiners seek Russian cargoes that are at discounted prices because of Western sanctions against Moscow.

Americas crude surge. Asia has largely replaced Saudi barrels with crude from the United States and Brazil, according to LSEG data. Imports from the United States rose to 1.67 MMbpd in April, up from 1.40 MMbpd in March and 1.16 MMbpd in February.

Asia's U.S. imports are forecast by LSEG to reach a record high of 1.76 MMbpd in May. Arrivals from Brazil increased to 1.28 MMbpd in April, up from 1.13 MMbpd in March and February's 840,000 bpd.

U.S. and Brazilian crude tends to be priced against U.S. West Texas Intermediate (WTI) futures, which trade at a discount to both Brent and Dubai. WTI closed at $79.12/bbl on Monday, a discount of $4.78 to Dubai's finish of $83.90.

Even accounting for higher freight charges, crude from the Americas can enter Asia at prices considerably cheaper than comparable grades from the Middle East.

There are limitations as to how much more oil from the Americas that Asian refiners can take, given many refineries are configured to run on medium and heavy crude, as opposed to the lighter grades typical of U.S. crude.

But within those restrictions it's clear that refiners are actively trying to move away from Middle East crudes as much as possible, a trend likely to continue until Aramco decides to lower its OSPs in order to maintain market share.

The opinions expressed here are those of Clyde Russell, a columnist for Reuters.

Comments