China's big refineries crowd out teapots for discounted Russian oil

(Reuters) - Chinese state oil giants and major private refiners are sweeping up more Russian crude, supporting prices and forcing smaller independents to seek out cheap alternatives such as Iranian oil, according to trade sources and shipping data.

The demand from China's biggest buyers, which had shied away from Russian crude in the immediate aftermath of Western sanctions on Moscow over its invasion of Ukraine, shows growing confidence in the trade after state refiners PetroChina and Sinopec resumed imports in February.

Large private oil refiners Hengli Petrochemical and Jiangsu Eastern Shenghong Co started receiving Russian crude from March, attracted by wide discounts for the oil, according to traders and shiptracking data from Refinitiv, Kpler and Vortexa.

Four cargoes of about 740,000 barrels each of low-sulfur ESPO crude discharged at Hengli's Dalian berth in March while another two arrived in April, the Kpler data showed. Shenghong imported a Urals crude cargo of about 720,000 barrels in March and 1 million barrels in April, Kpler showed.

In April, PetroChina received a Urals crude cargo of 1 million barrels via Myanmar's Made Island port, which is linked by pipeline to its Yunnan refinery, the Kpler data showed.

PetroChina, Hengli and Shenghong did not reply to requests for comment.

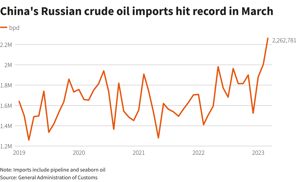

China's overall Russian crude imports, including pipeline and ships, rose to a record 9.61 million tons, or 2.26 million barrels per day (bpd) in March, customs data showed on Friday.

"China's imports of Russian Urals are on track to break March's record (in April) as more refiners start to tap on the discounted crude from Russia's Baltics," said Vortexa analyst Emma Li.

Around 700,000 bpd of Urals may reach China in April, up from 600,000 bpd in March, she said.

Russia's oil exports from western ports will rise to the highest since 2019, despite Moscow's pledge to cut output.

Discounts for Urals crude arriving to China in July have narrowed to about $9-$10 a barrel to ICE Brent futures on a delivered ex-ship (DES) basis, from around $14 a barrel for March arrivals, traders said.

Similarly, ESPO for June delivery has traded at discounts of about $5.50 a barrel to ICE Brent futures, they added, up from discounts of $6 and $8.50 a barrel for cargoes arriving in May and March, respectively.

Teapots

Smaller Chinese independent refineries, known as teapots, snapped up almost all of the ESPO supplies between November and January when others steered clear of Russian oil around the start of the European Union ban on Dec. 5.

With the return of big buyers, price-sensitive teapots are looking for alternatives such as Russian Arctic grades, Iranian and Venezuelan oil.

Shandong province, home to most of the teapots, imported a record 4.2 million barrels of Varandey crude from the Russian Arctic in March, Kpler data showed, as Europe shut the oil out.

China's customs data showed no crude imports from Iran and Venezuela in March as these cargoes are often rebranded as oil from other countries to evade sanctions.

But 1.07 million bpd of crude were shipped from oil transfer hub Malaysia to China last month, up 64% from the average during the January-February period.

China imported about 409,000 bpd of Iranian crude in March, more than double January's volume, Kpler data showed. Vortexa has a higher estimate for March at about 800,000 bpd and expects volumes to increase in coming months.

Iranian oil for June-arrival is priced at a discount of about $11 a barrel against ICE Brent futures, slightly cheaper than Urals, traders said.

Prices of diluted bitumen, a catch-all phrase for what is typically Venezuelan crude mixed with other oils that is claimed as exported from Malaysia to avoid sanctions, have also strengthened on robust demand from teapots, the traders said.

Discounts for the oil for May delivery have narrowed to about $17 a barrel against ICE Brent futures, versus about $27 a barrel for February delivery, according to traders.

Comments