Low-carbon hydrogen demand in refining could reach 50 Mtpy by 2050

Potential low-carbon (green or blue) hydrogen demand from the global refining sector could reach 50 MMtpy by 2050, says Wood Mackenzie, a Verisk business.

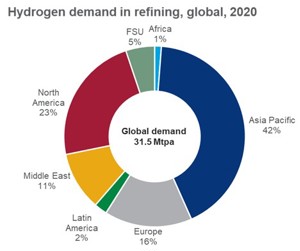

Oil refining is one of the largest markets for hydrogen, accounting for about 32 Mtpy or 30-35% of global hydrogen demand in 2020. Hydrotreating and hydrocracking are the major refinery processes consuming over 90% of hydrogen in the refining sector, and they are used to reduce sulphur from finished products, and to increase yield of transport fuels, respectively.

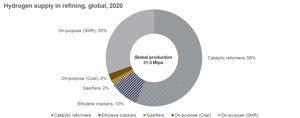

However, more than 65% of hydrogen demand in refining is met by hydrogen supplied as a by-product from catalytic reformers and ethylene crackers; this is unlikely to be replaced by low-carbon hydrogen. Any hydrogen shortfall is met by on-purpose production from gas-based steam methane reforming (grey) and coal (brown), together accounting for about 32% of refinery hydrogen demand.

Wood Mackenzie research director Sushant Gupta said: “Low-carbon hydrogen has the potential to replace on-purpose hydrogen as a feedstock if low-carbon hydrogen becomes cost competitive and policy support develops over time. Potential global market size for low-carbon hydrogen in this segment could be up to 10 Mtpy by 2050 delivering a 10% or 100 Mtpy reduction in overall scope 1 and 2 global refinery carbon emissions.

“But the real game-changer is in replacing fossil fuels in combustion applications to generate heat and steam. This will provide a larger market for low-carbon hydrogen in refining with potential market size reaching up to 40 Mtpy by 2050, and up to 300 Mtpy or about 25% reduction in carbon emissions. As such, total potential demand for low-carbon hydrogen in refining could be up to 50 Mtpy by 2050.”

For further decarbonization, refiners will have to consider additional low-carbon technologies such as electric heating, carbon, capture and storage on main carbon emitting units and biomass gasification. Refiners will have to deploy renewable power and use low-carbon feedstocks and products. A combination of these solutions is required to solve this complex problem.

Both lower costs and high carbon prices are needed to make low-carbon hydrogen competitive to on-purpose fossil fuel-based hydrogen. Cost is important because hydrogen production is responsible for between 10% and 25% of refiners’ variable opex. In addition, a high carbon price and related emissions penalty could become the main driver of shifting away from fossil fuel-based hydrogen to low-carbon hydrogen. At current high and volatile gas/LNG prices and in the aftermath of the Russia/Ukraine war, green hydrogen is cheaper than fossil fuel-based grey hydrogen. So, there is market opportunity to diversify hydrogen supply sources to reduce emissions and support energy security.

In the case of combustion applications, higher heating value and lower emissions make low-carbon hydrogen an attractive alternative. Although combustion provides a bigger market, low-carbon hydrogen needs to achieve a much lower cost, or a much higher carbon price is needed to compete in the combustion sector than that required to compete with on-purpose hydrogen. A much higher carbon price of US$100 per ton (t) to US$150/t would be required in the early 2030s to make low-carbon hydrogen compete in the refinery combustion sector, assuming commodity prices return to levels driven by long-term fundamentals. Alternatively, green hydrogen cost must be sub-US $1.50 per kilogram to compete with gas and fuel oil combustion in the longer term.

Gupta said: “In addition to falling costs for low-carbon hydrogen, higher carbon prices, financial incentives and stronger policy support will be necessary to accelerate adoption by the refining sector. Dedicated country hydrogen roadmaps will help grow low-carbon hydrogen’s penetration across many sectors.

“From costs and emissions perspective, a leap towards green hydrogen rather than blue is more likely in refining in the longer term. However, countries with low-cost gas resources and CO2 sequestration capacity will have the opportunity to enter the blue hydrogen market. Replacement economics for low-carbon hydrogen is hugely dependent upon coal, gas, carbon and renewable power prices and hence, very refinery site and country specific.”

Comments