2020 AFPM Summit: Eyeing demand recovery in a post-COVID-19 world

Eyeing demand recovery in a post-COVID-19 world

ADRIENNE BLUME, Executive Editor, Hydrocarbon Processing

At AFPM's virtual Summit on Tuesday, Robert Auers, Senior Consultant at Turner, Mason & Company, hosted an afternoon session on challenges in the U.S. refining sector, including how COVID-19 has affected the short-term global demand for refined products and the prospects for demand longer term.

Tracing the path of COVID-19 and regional responses. Among developing countries, long-term lockdowns are not possible due to the high costs associated with increased hunger, lower vaccination rates and other factors. While many developing countries attempted lockdowns from March to May, most have been forced to switch to a "flatten the curve" model, with the exception of the Philippines and Peru.

Turner, Mason & Company believes that as COVID-19 cases and deaths decrease, restrictions will be lifted, virus fears will ease and life will begin to return to normal in developing countries. Chinese demand has already recovered to near pre-COVID-19 levels. Most of Latin America and India have lagged in their virus recovery, but recovery is now in full force.

Among developed countries, the U.S. is primarily following the "flatten the curve" approach. Further re-openings are expected as cases, hospitalizations and deaths decrease. Turner, Mason & Company does not foresee a second wave of COVID-19 in the autumn, based on empirical evidence gathered to date.

Europe had already flattened its curve, but COVID-19 is now starting to return in some areas. The region is not expected to impose a second round of lockdowns. Responses will vary by country and be important in determining the pace and trajectory of the recovery. Australia and New Zealand, meanwhile, have decided to eradicate the virus through lockdowns and other measures.

Most of the rest of developed Asia has been able to avoid large virus outbreaks without widespread lockdowns, but this could change in autumn. Japan and South Korea have seen new, small outbreaks and have attempted new restrictions, although these restrictions have been met with more public resistance than was seen in March and April.

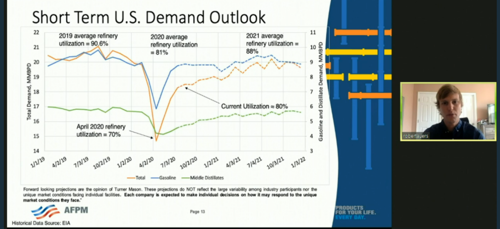

Virus impact on fuel demand. COVID-19 is affecting short-term global demand for refined products. Demand in 2020 is forecast to be 1.5 MMbpd below that of 2019, although less of a drop-off will be seen in U.S. demand after the summer driving season, since people will become more mobile toward the end of the year with further re-openings (FIG. 1). This lost demand is anticipated to narrow from 2023–2025.

FIG. 1. Short-term U.S. demand outlook.

U.S. refinery utilization dropped to 70% in April and has recovered to only 80% in August on fuel stockbuilds and slow demand recovery in South and Central America. However, Turner, Mason & Company forecasts strong recovery in refinery utilization into 2021 on small improvements in fuel demand and permanent refinery closures.

Diesel demand recovery has been slow amid the pandemic. Jet fuel was hit the hardest, and its recovery is anticipated to be very slow as business and personal travel continues to be curbed. Economic concerns will limit flying into early 2021. However, jet fuel demand is expected to recover quicker than it did post-September 11.

US refiners are responding in various ways to this demand decline, including adjusting operations to maximize gasoline and diesel production according to price signals. New investments, along with the closure of some gasoline-heavy refineries, will permanently lower the gasoline/diesel ratio at U.S. refineries.

The U.S. is expected to turn negative on fuel demand growth before 2025, with any future growth coming from distillates and petrochemical feedstocks. U.S. fuel exports will continue to find a home in South and Central America and expand into West Africa.

Total Middle East demand will resume a growth trajectory as the rates of decrease for direct crude and resid burn for electricity production slow. As a result, total Middle Eastern demand will expand due to demand growth for other petroleum products (gasoline, middle distillates, petrochemical feedstocks, etc.) Asia's demand growth, however, is likely to slow considerably beyond 2025.

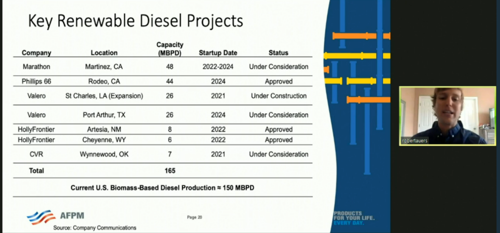

Refiner responses to demand shifts. U.S. refiners are looking at renewable diesel projects at a number of plants (FIG.2). PADD 3 (Gulf Coast) refiners will make renewable diesel for California to meet low carbon fuel standard (LCFS) requirements and avoid buying LCFS credits.

FIG. 2. Key renewable diesel projects.

Globally, refinery construction and revamp projects through 2024 will account for approximately 1 MMbpd in excess of 2019 forecast demand growth. Between capacity creep and refinery shutdowns, around 1 MMbpd of refinery capacity must be scrapped through mid-decade to balance supply and demand. Temporary refinery closures of 1.471 MMbpd have been announced worldwide in response to COVID-19 economics, and a portion of these capacity closures will become permanent.

In summary, Turner, Mason & Company does not view COVID-19 as a game-changer in itself. While significant uncertainty remains, demand is expected to continue to recover. COVID-19 has accelerated some demand destruction trends while slowing others. Investment delays and project cancelations will help mitigate the supply/demand imbalance.

Post-2023, Turner, Mason & Company expects the industry to be minimally impacted by COVID-19. However, it could see impacts from other ongoing events, such as a continued economic recession or an extended cold war between the U.S. and China.

Comments